UNDERSTANDING MUTUAL FUND

A mutual fund is a trust that pools the savings of several investors and then invests these into different kinds of securities (shares, debentures, money market instruments, or a combination of these) in keeping with a pre-stated investment objective. The income thus generated and the capital appreciation is distributed among mutual fund unit holders in proportion to the number of units held by them.

Net Asset Value(NAV) of a Fund

The Mutual Fund Net Asset Value or NAV is the total market value of all the assets, including cash, held by the fund, after deducting its liabilities. The per unit NAV represents the market value of one unit of the mutual fund. It is the price at which investors can buy or redeem the mutual fund’s units. The per unit NAV is computed by dividing the total value of all the assets of the mutual fund, less any liabilities, by the number of units outstanding.

Benefits of investing in Mutual Funds

Diversification

Diversification involves holding a wide variety of investments in a portfolio so as to mitigate risks. Mutual funds usually spread investments across various industries and asset classes, constrained only by the stated investment objective. Thus, by investing in mutual fund, you can avail of the benefits of diversification and asset allocation, without investing the large amount of money that would be required to create an individual portfolio.

Professional Management

Mutual funds employ experienced and skilled professionals, who conduct investment research, and analyse the performance and prospects of various instruments before selecting a particular investment. Thus, by investing in mutual funds, you can avail of the services of professional fund managers, which would otherwise be costly for an individual investor.

Liquidity

In an open-ended scheme, unit holders can redeem their units from the fund house anytime, by paying a small fee called an exit load, in some cases. Even with close-ended schemes, one can sell the units on a stock exchange at the prevailing market price. Besides, some close-ended and interval schemes allow direct repurchase of units at NAV related prices from time to time.

Flexibility

Mutual funds offer a variety of plans, such as regular investment, regular withdrawal and dividend reinvestment plans. Depending upon one’s preferences and convenience, one can invest or withdraw funds, accordingly.

Cost Effective

Since mutual funds have a number of investors, the fund’s transaction costs, commissions and other fees get reduced to a considerable extent. Thus, owing to the benefits of larger scale, mutual funds are comparatively less expensive than direct investment in the capital markets.

Well Regulated

Mutual funds in India are regulated and monitored by the Securities and Exchange Board of India (SEBI), which strives to protect the interests of investors. Mutual funds are required to provide investors with regular information about their investments, in addition to other disclosures like specific investments made by the scheme and the proportion of investment in each asset class.

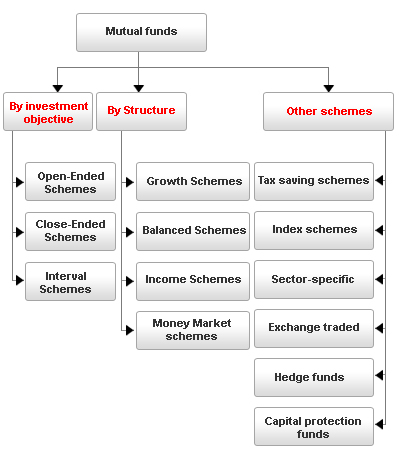

Mutual funds are classified on the basis of their

- Structure

- Investment objective

Open-ended schemes

These funds do not have a fixed maturity and one can invest in such funds on any working day, during business hours. Investors can buy or sell units of open-ended schemes directly from the fund house at NAV related prices.

Close-ended schemes

Such funds have a fixed maturity period and are open for subscription only for a specified period. After the expiry of this period, investors can buy or sell the units on the stock exchanges where such funds are listed. Some funds also have the option of periodic repurchase, whereby investors can sell back their units to the fund at NAV related prices.

Interval schemes

Interval schemes are a combination of both open and close-ended schemes. Investors can purchase or redeem their shares from the fund house at pre-determined intervals at NAV related prices

Growth schemes

Such funds are aimed at capital appreciation over the medium to long term. Usually, such funds invest a major portion of the portfolio in equities.

Balanced schemes

Such funds have a balanced portfolio and invest in equity and preference shares in addition to fixed income securities. The aim of such funds is to provide both income and capital appreciation over a long-term.

Income schemes

These schemes invest primarily in fixed income instruments issued by the government, banks, financial institutions and private companies. The main objective of income schemes is preservation of capital and to provide fixed income over the medium to long term.

Money market schemes

Money market schemes invest in short-term debt instruments, which earn interest and have high liquidity. Though these are considered to be the safest investment option, such funds are subject to fluctuations in the rates of interest.

Tax saving schemes

Such schemes are aimed at offering tax rebates to investors under specific provisions of the Income Tax Act, 1961. For instance, investors of Equity Linked Savings Schemes (ELSS) and Pension Schemes are applicable for deduction u/s 88 of the Income Tax Act, 1961.

index schemes

Such funds strive to mirror the performance of specific market indices, such as the BSE SENSEX, CNX Nifty, etc which are called the base index. Investments in such funds are made in the same stocks as the base index and in similar proportion.

Sector-specific schemes

Such funds invest in a specific industry or sector. The investments could be in a particular industry (Banking, Pharmaceuticals, Infrastructure, etc) or a group of industries, or various segments (like ‘A’ Group shares).

Exchange-traded funds

Such funds are listed and traded on the stock exchange in a similar manner as stocks. Such funds invest in a basket of stocks and aim at replicating an index (S&P CNX Nifty, BSE Sensex) or a particular industry (banking, information technology) or commodity (gold, crude oil, petroleum).

Capital protection funds

These funds are designed to safeguard the capital invested therein, by investing in suitable securities.

Earning From Mutual Funds

How to pic the right Fund

Different schemes entail different levels of risks, depending upon their portfolio composition and fund objective. However, a person should not just blindly select any scheme.

Mutual funds |

Degree of Risk |

Money Market Funds |

Low |

Income funds |

Low to Medium |

Balanced Funds |

|

Growth Funds |

Medium to High |

Every person has a different risk profile, which depends upon his personal attitude towards risks, age, income, liabilities, objectives, knowledge about financial markets and the term of investment. You should select a suitable mutual fund scheme according to your risk profile.

For instance, a person who has a low risk profile would be better off investing in a scheme with low risk, viz. money-market funds.

You have to match your risk profile to that of the scheme and then make a suitable choice

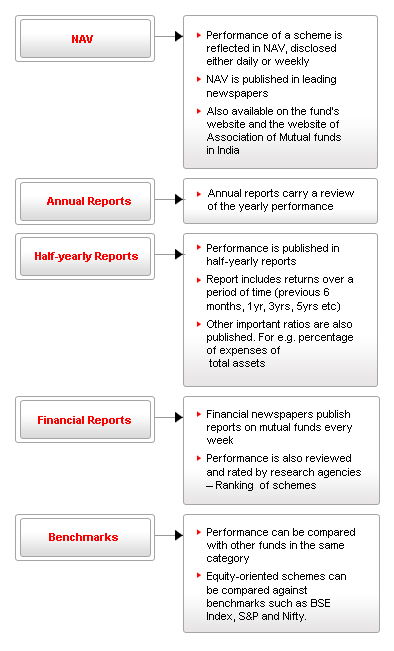

How to keep regular track of a Mutual fund investments

You can keep a track of your mutual fund investments through any of the following —

SYSTEMATIC INVESTMENT PLAN

It is more famously known as SIP. It is bit by bit systematic investment. Under this plan your investments are staggered. That is you invest a fix sum either monthly or quarterly in a mutual fund. Say, for example, you commit to invest a pre-specified amount (Rs 500 onwards) every month or every quarter in a mutual fund. You fix a date on which every month or every quarter the amount gets invested. The first investment has to be by a cheque and then you can either give post dated cheques (PDCs) or opt for electronic clearing system (ECS).

In ECS you give permission for the amount to be directly deducted from your bank account on the fixed due date. The units are allocated as per the then prevailing NAV on that day of the month. You get more number of units if the NAV is low and vice versa if the NAV is high.

Rupee cost averaging

It means averaging the cost price of your investments.

SIP helps in averaging the cost as equal amount is invested regularly every month at different NAVs. SIP works well in a volatile market as in the months where markets are down you get more number of units as the NAV is down and when the markets are up you get less number of units. But over all the prices gets averaged out.

Let us see how: Say you make your first investment of Rs 1,000 at a NAV of Rs 10. In this case, the units acquired will be 100 (1,000/10). You make the next investment of Rs 1,000 at a NAV of Rs 12. Units acquired now will be 83.33333 (1,000/12). Now also suppose that you make the third investment of Rs 1,000 at a NAV of Rs 9 and the units acquired will be 111.1111 (1,000/9).

The average purchase cost works out to Rs 10.19 (3,000/294.4444).

This concept, however, may not work in a rising market. As the markets are constantly rising you acquire less and less units and the average cost does not work in our favour. This is especially true in the shorter period. But in the long term scenario the market is volatile, the cost is averaged out and the downside risk is protected

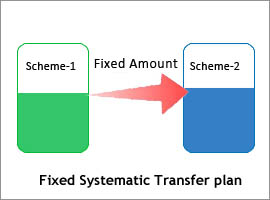

SYSTEMATIC TRANSFER PLAN

Imagine a scenario when you want to invest a big lump sum amount in stock market ? As markets are volatile and can go up or down very soon , there is always risk of loosing a big chunk of your investment (Learn about Stock Markets) . Take a case where you want to invest 10 lacs in Equity Mutual funds and suddenly market crashes for next 2 months, In this case a big chunk of your investment will be lost, on the other hand if market moves up pretty fast, you can make a good profit. Here you have to decide your main focus. If it’s minimizing risk and getting good decent returns in long-term, You should use something called Systematic Transfer Plan (STP).

What is STP (Systematic Transfer Plan)

You should first understand SIP . SIP is way of investing in Mutual funds monthly, where a fixed amount of money goes from your Bank Account to Mutual funds, so if you do a SIP of 1,000 for 1 yr, it means that every month on a fixed date (chosen by you) 1,000 will be invested in a Fixed Mutual fund you choose. Lets understand STP now, In STP we invest a lump sum amount in some Mutual Fund and then a fixed sum is transferred from that mutual fund to another mutual fund .

For Example : If you have Rs 6 lacs lump sum to invest and you want to invest in HDFC Top 200 , The steps you will have to follow are :

1.Choose a good Debt fund or Floating Rate Mutual Fund from HDFC , which allows STP to HDFC Top 200 .

2.Invest all the money in the Debt Fund .

3. Now you can start a 10k/20k/30k per month STP from HDFC Debt fund to HDFC Top 200 .

Why and When to use STP

When will it work : STP will make sense from DEBT -> EQUITY when markets are mayvery volatile and you dont want to take risk with your money in a short span of time, If you invest through STP in markets and markets fall or have lots of volatile moves, then this situation will be better than the one time investment option. This is still better than putting money in Bank and doing a SIP, because at least you money is earning some returns on debt part in STP .

When will it not work : Incase markets are already at the end of a Bear market and markets can starts it upmove anytime, in that case STP will not deliver the best returns like SIP, one time investment is a good choice in that case. But then you never know that when will markets start go up. Given that a retail investor does not have all the tools and time to research the markets, it’s not advisable to invest lump sum in any case. It’s better to get 4-5% less returns than to see a huge downside of your money in short time, Smart investors think about returns, Smartest one’s take care of risk first .